In collaboration with Flynance – Anais Huré & Daniel Ding

Learn more about Flynance on their website. Follow their journey on Instagram and TikTok.

This workshop was designed especially for women living in Germany, to help us understand key financial concepts, start investing with confidence, and make our money work for us — building a strong, independent financial future.

🙋🏽♀️ Financial Realities for Women

-

Conservative investors: Women tend to invest more cautiously, which can slow down wealth growth.

-

Gender pay gap: The difference between the average hourly pay of men and women in Germany is around 16%. This is partly due to biases where women — especially mothers — are perceived as less competent or less committed, impacting promotions, salaries, and access to training.

-

Financial literacy gap: Many women have less exposure to financial education, making it harder to seize investment opportunities.

-

It’s about freedom and equality: Financial independence isn’t just about money — it’s about having choices, security, and the ability to live life on your own terms.

📊 Foundations of Financial Health

-

Cashflow awareness:

Net salary – fixed costs = free liquidity.

Your consumption rate should be a maximum of 70% of your net income. -

Emergency fund: 3–6 months of net income saved to cover unexpected expenses.

-

Insurance basics:

-

Health insurance (mandatory in Germany)

-

Liability insurance – 90% of people in Germany have it

-

Disability insurance – Coverage depends on age, occupation, and work-related risks

-

Why insurance matters: Protects against financial losses from burnout, depression, stress, cancer, spinal/movement issues, and other serious health challenges.

💰 Where to Invest

Short-term investments – focus on safety & liquidity:

-

Savings accounts

-

Emergency funds

Mid-term investments – aim for growth with manageable risk:

-

Stocks

-

ETFs (Exchange-Traded Funds) – a basket of diversified investments

-

Real estate

-

Private equity

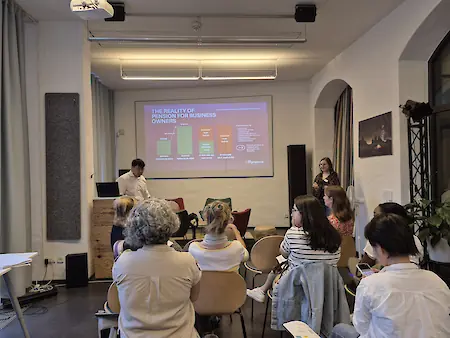

Long-term investments – build retirement & legacy:

-

Public pension (eligible after 5 years of work in Germany, even if retiring abroad)

-

Private retirement plan (e.g., Rürup – fully taxable, Riester, flexible private plans)

-

Company pension plans

-

Group investment schemes

Insurance as part of financial stability:

-

Health

-

Liability

-

Disability

-

Other tailored insurance depending on your life stage

💡 The first step is the hardest — but start small! You don’t need a large sum to begin investing.

🗒️ Mindset & Common Mistakes

Mindset for Successful Investing

-

Long-term thinking — focus on sustainable growth, not quick wins

-

Discipline over emotion — avoid impulsive decisions

-

Consistency — small, regular investments add up over time

-

Risk awareness — understand the risks before you commit

-

Goal-oriented approach — align your investments with your personal and financial goals

Common Mistakes to Avoid

-

Chasing trends or hype without research

-

Panic selling during market drops

-

Lack of diversification (putting all your money in one type of investment)

-

Unrealistic expectations about returns and timelines

💡Reflection Questions

-

5 things you want to have or do during retirement.

-

What steps can you take now to make those goals possible?